R&D Tax Credit Claims See Significant Decline

26 Sept, 20243 minutesThe recent statistics for the 2022/23 tax year have highlighted a significant shift in the l...

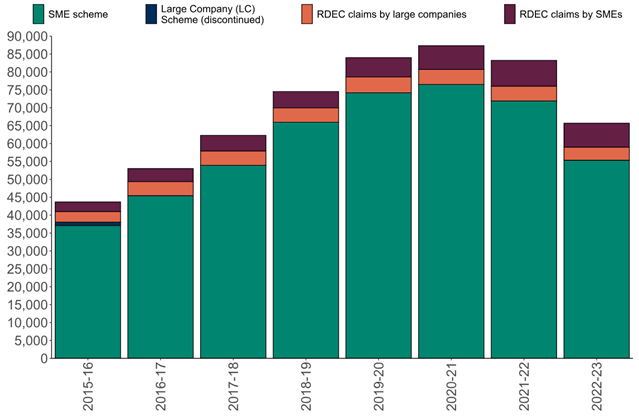

The recent statistics for the 2022/23 tax year have highlighted a significant shift in the landscape of Research & Development (R&D) tax credits, with a notable drop in the number of businesses claiming the relief. Despite the total value of R&D tax credit claims rising to £7.5 billion, an increase of £1 billion compared to the previous year, the number of claims fell dramatically by 65,690. This reduction was particularly evident among Small and Medium Enterprises (SMEs), where claims decreased by 23%.

At JS, we believe that R&D is a cornerstone for economic growth and innovation. The significant decrease in the number of claimants is a cause for concern, as it suggests that the additional administrative burdens of the Additional Information Form (AIF) and the increasing scrutiny from HMRC may be deterring businesses from applying. While efforts to reduce fraud and overstated claims are necessary, legitimate qualifying businesses mustn't be dissuaded from accessing this valuable relief.

The shift in R&D tax credit distribution

The statistics also reveal a shift in the distribution of claims between the two primary schemes, the SME Scheme and the R&D Expenditure Credit (RDEC) Scheme. SME claims accounted for £4.5 billion, while RDEC claims were valued at £3.5 billion. Interestingly, although expenditure under the RDEC scheme rose by 7%, the number of claims under this category fell by 9%, indicating a trend towards fewer but larger claims.

JS sees this as a reflection of the increasing complexity and costs associated with filing claims, especially for smaller businesses. The decline in the number of claims, coupled with an increase in claim value, suggests that while larger companies with substantial R&D investments continue to benefit, smaller firms may be struggling to justify the costs involved in claiming.

Sector and regional trends

The majority of claims continue to originate from the IT, manufacturing, and scientific and technical sectors, which together accounted for 67% of all R&D claims and 70% of RDEC claims. Geographically, London and the South East remain the most active regions for R&D claims, whereas Northern Ireland, Wales, the North East, and Scotland report the fewest claims. This regional disparity highlights the need for more targeted support to encourage R&D activities across all parts of the UK.

JS is particularly concerned about the implications for start-ups and small businesses, which are often the drivers of innovation. The reduction in new claimants, particularly first-time applicants, is alarming. R&D tax relief is critical for the success and growth of these young companies, and the current trends suggest that additional support and encouragement are needed to reverse this decline.

Impact of administrative and financial barriers

The additional administrative requirements introduced by HMRC, including the new Additional Information Form (AIF), have added complexity to the claims process. Coupled with the reduced tax benefit and the rising professional fees associated with making a claim, these factors are likely contributing to the decline in the number of claims.

Many small businesses are now hesitant to pursue R&D claims due to the perceived risk of an enquiry from HMRC. This perception, combined with the financial burden of preparing a claim, has led many to conclude that the potential rewards do not justify the effort and cost involved.

Addressing error and fraud in R&D claims

HMRC’s recent annual report underscores the challenge of managing error and fraud within the R&D tax credit scheme. Although specific data for 2022/23 is yet to be released, HMRC has estimated that the potential level of error and fraud for the 2023/24 tax year could reach £601 million, representing 7.8% of total R&D expenditure. This projection reflects both legislative changes and enhanced operational measures aimed at tightening the scheme.

At JS, we support measures that protect the integrity of the R&D tax relief system. However, we urge HMRC and policymakers to strike a balance that does not place undue burden on genuine claimants. The goal should be to create an environment that both prevents abuse of the system and encourages businesses to invest in innovation.

Moving forward

The decline in R&D tax credit claims presents challenges for both businesses and the wider economy. JS remains committed to guiding our clients through these changes, helping them access valuable relief despite the obstacles.

Staying informed about R&D tax credit changes and seeking expert advice is crucial. At JS, we assist clients in understanding their eligibility and developing their R&D strategy throughout the year. Collaboration is key to navigating the complexities of the R&D schemes, meeting the increased requirements, capturing evidence in real time to support claims and reducing the risk of enquiries.

For more information on how JS can assist with R&D tax credits, please contact our R&D team:

📧 RandD@teamjs.co.uk

📞 01942 292500

🌐www.jacksonstephen.co.uk

Our R&D Tax Director Kay Oldham’s comments on the decline in the number of R&D claims were also published in Accountancy Daily Magazine on 27 September 2024. You can read Kay’s comments here:

https://www.accountancydaily.co/number-rd-claims-drop-while-expenditure-rises