Should employees reimburse their employer for private fuel?

16 Jun, 20234 minutesThe table below sets out the HMRC advisory fuel rates that apply from 1 June 2023. These are...

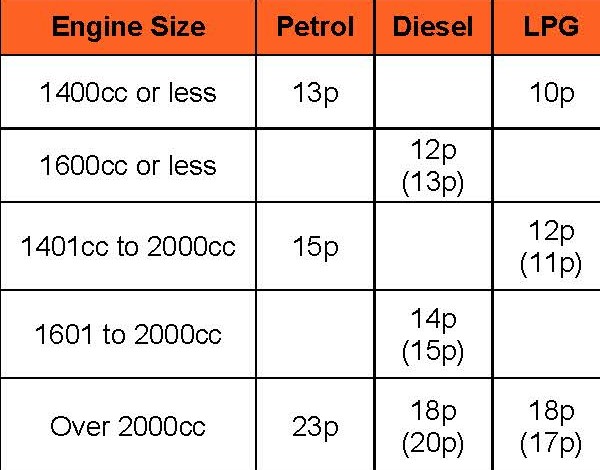

The table below sets out the HMRC advisory fuel rates that apply from 1 June 2023. These are published quarterly these days due to the volatility in petrol and diesel prices in recent years. Where the employer provides an employee with a company car, there may be an additional benefit in kind on the provision of fuel for private journeys, which needs to be reported on form P11d:

(Where there has been a change, the previous rate is shown in brackets).

This additional benefit is based on a notional list price for the vehicle of £25.300 for 2022/23 which applies irrespective of the original list price of the vehicle normally used to compute the taxable benefit. That figure is then multiplied by the CO2/km percentage for that vehicle.

For example, the Range Rover Evoke S AWD Automatic MHEV has a current list price of £41,245. The CO2 emissions data on the Land Rover website is 168g/km for this vehicle, which means that the fuel benefit is 37% multiplied by £25,300 = £9,361.

For a higher-rate taxpayer, that would result in a tax liability of £3,744. That would be an awful lot of fuel! In addition, the employer would have a Class 1A national insurance liability of £1,360 (14.53% for 2022/23). Provided private fuel is fully reimbursed, the fuel benefit does not apply. This is an all-or-nothing benefit and unless there is full reimbursement there is an additional taxable benefit. The deadline for reimbursing private fuel is 6 July 2023 for the 2022/23 tax year.

For more information, please talk to our tax experts at js.tax@jsllp.co.uk, we will be delighted to assist!