As a practice that is continually looking to be at the forefront of innovation and tech...

As a practice that is continually looking to be at the forefront of innovation and tech...

As a practice that is continually looking to be at the forefront of innovation and new techn...

An Audit is much more than just numbers to us, it is ensuring strong foundations for the fut...

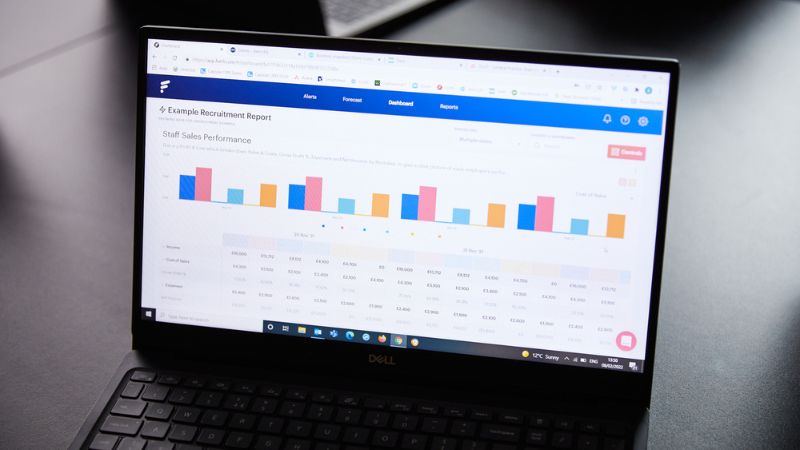

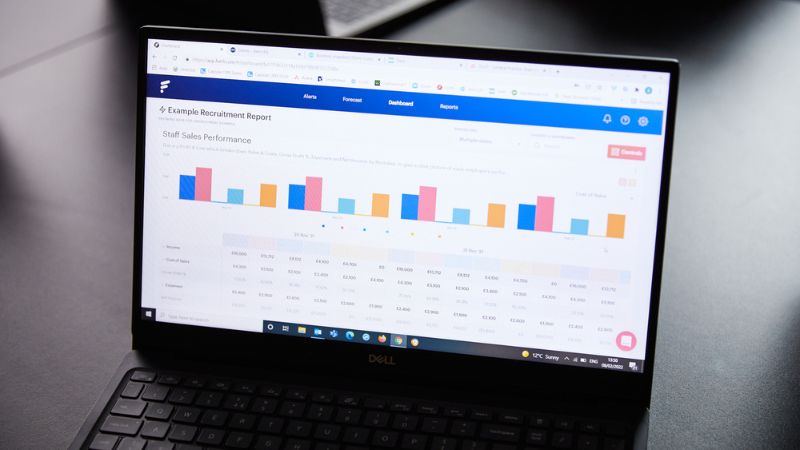

As you know, we are very keen to ensure that our clients have access to the accurate, real-t...

North West-based accountancy and business advisory practice, Jackson Stephen, has undergone ...

Business clients who have been with us for some time will know that the tax code provid...

For many years it has been the employer’s responsibility to report employees’ benef...

The JS team got well and truly into the spirit of pancake day, as our social committee organ...

At JS we support our team throughout their whole learner journey, helping them to become ful...

Professional services businesses typically need to manage a high number of projects&nbs...